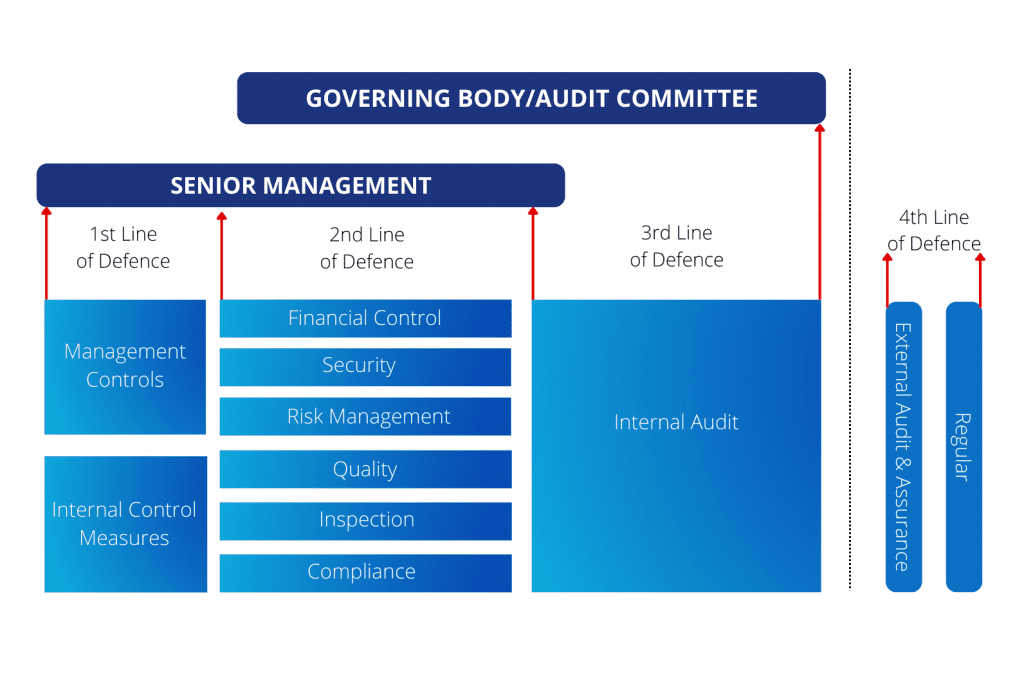

The Four Lines of Defence model is a valuable framework for assessing and enhancing an organisation’s risk management, control, and assurance processes. It helps organisations understand the different layers of protection and oversight. Let’s break down each line:

First Line of Defence: Control Frameworks and Day-to-Day Controls

The first line encompasses the organisation’s day-to-day operations and includes control frameworks, risk management systems, and controls over operational processes. These controls are implemented by staff directly involved in the business processes. Examples include transactional controls, quality checks, and approval processes.

- Assurance at this level comes from the knowledge and commitment of staff operating the controls.

- Benefits: Staff familiarity with business processes and the ability to identify weaknesses.

- Weakness: Lack of independence due to self-review.

Second Line of Defence: Management Review

The second line involves independent review separate from day-to-day operations. It includes risk and compliance reviews, financial controls oversight, and board-level supervision. Reviewers are not directly responsible for the areas being reviewed, introducing a degree of independence.

- Challenges: Reviewers still part of the same management team, limiting complete objectivity.

Third Line of Defence: Internal Audit

The third line consists of the internal audit function. Internal auditors provide independent assessments of controls, risk management, and compliance. They evaluate the effectiveness of controls and identify areas for improvement.

- Benefits: Greater independence than the first two lines, specialized expertise.

- Limitations: Still part of the organisation, potential conflicts of interest.

Fourth Line of Defence: External Assurance

The fourth line focuses on external assurances provided by external assessors, regulators, and other external bodies. These external parties assess an organisation’s controls, financial reporting, and compliance. Examples include external audits, regulatory inspections, and certifications.

- Assurance at this level is critical for stakeholders’ confidence.

- Benefits: Independence, specialised expertise, and credibility.

- Challenges: Limited frequency (usually annual), reliance on external parties.

The Importance of External Assurance

The fourth line of defence plays a pivotal role in ensuring transparency, accountability, and trust. Let’s explore its components:

External Audits

- Conducted by independent audit firms, external audits verify the accuracy of financial statements.

- Auditors assess internal controls, identify risks, and provide an opinion on the fairness of financial reporting.

- Stakeholders, including investors and creditors, rely on audit reports for decision-making.

Regulatory Inspections

- Regulatory bodies (such as financial regulators, health authorities, or environmental agencies) perform inspections.

- These inspections ensure compliance with laws, regulations, and industry standards.

- Non-compliance can result in penalties or legal consequences.

Certifications and Standards

- Organisations seek certifications (e.g., ISO, SOC, or industry-specific certifications) to demonstrate adherence to best practices.

- These certifications are often externally validated.

- Compliance with standards enhances an organisation’s reputation and competitiveness.

In summary, the fourth line of defence provides external validation—assuring stakeholders that an organisation’s controls and processes meet high standards. Organisations must actively engage with external assessors and regulators to maintain trust and credibility.

Our team at FEFO Consulting conduct diagnostic surveys that play a critical role in validating an organisation’s processes, controls, and compliance. We operate independently of the organisation, ensuring objectivity in our assessments that brings a fresh and valuable viewpoint.

Remember, while the first three lines of defence are essential, the fourth line adds an extra layer of confidence through external scrutiny.

To learn more about using external survey as a form of assurance, contact us.